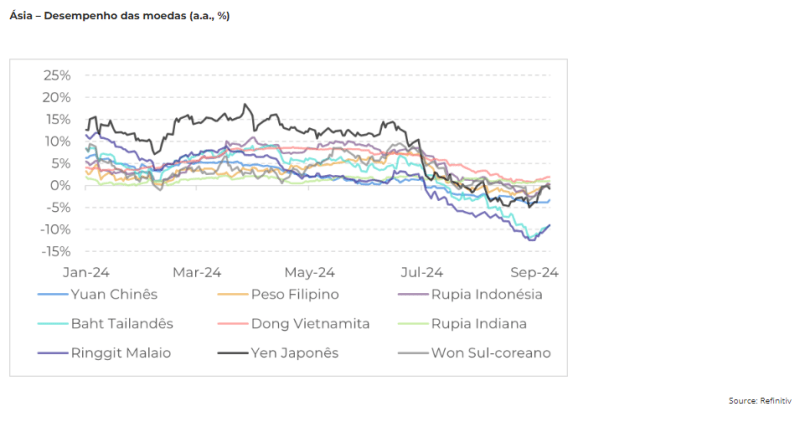

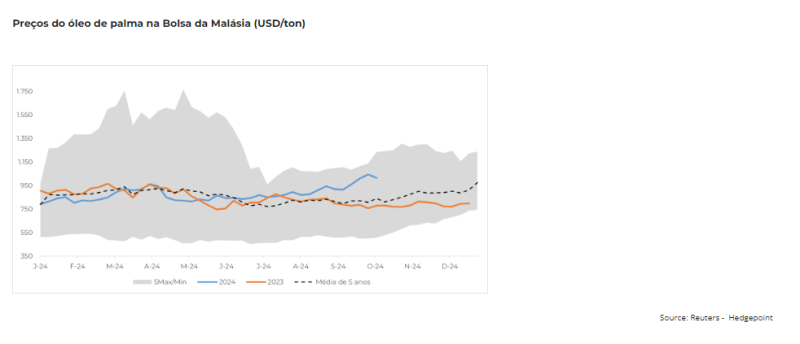

The prices of Palm oil have seen significant increases in recent months, with the main factor being the appreciation of the Malaysian ringgit against the US dollar.

According to Ignacio Espinola, senior grains analyst at Hedgepoint Global Markets, Asian currencies have started to gain strength after a period of depreciation. This movement is a result of the weakening of the dollar, caused by the monetary easing decided by the FOMC in September.

Furthermore, there are expectations of higher growth in the Asian continent for 2025. As more central banks find room to cut interest rates, these economies are being boosted.

In addition to the exchange rate issue, there are concerns related to the new policies of the European Union (EU), the new mandate in Indonesia and the recent conflict in the Middle East.

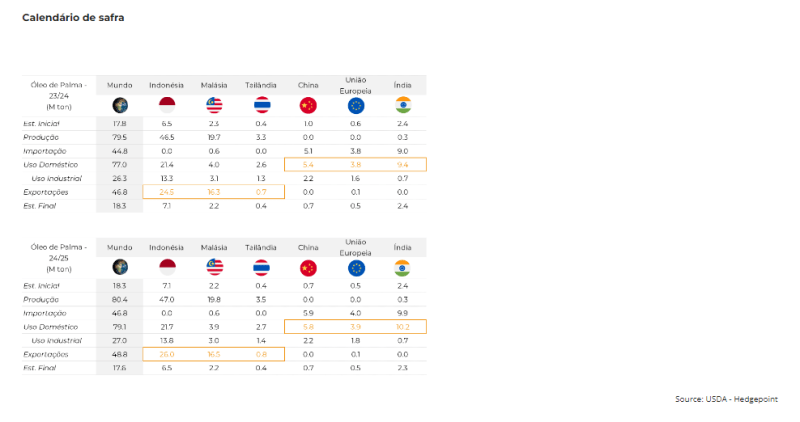

Supply and demand in the palm oil market

Espinola points out that “when we look at supply and demand for the next palm oil harvest, we don’t see any major changes compared to the previous year. We expect small adjustments in production, but without significant impacts.” Malaysia, for example, should improve its yield, but the harvested area will balance the increase, without generating major changes in total production.

The analyst points out that the main factor driving prices is outside the supply and demand balance: “world production will be very similar to the previous harvest, as will other variables. This indicates that the reason behind the rise in prices lies in external factors.”

Indonesia’s B40 and EUDR legislation in Europe

Indonesia is about to implement the B40 program, which will replace the current B35 in 2025. “B40 will increase the palm oil content in biodiesel from 35% to 40%, increasing the demand for palm oil and, consequently, reducing its availability for other uses,” explains Espinola.

Meanwhile, the EUDR requires companies to ensure that their products, such as palm oil, are not associated with deforestation. The European Union had planned to start implementing this regulation on December 30, 2024. However, the start date has been postponed by a year. This decision was made after pressure from countries such as Germany and Sweden.

Palm oil producers in Asia are closely monitoring this legislation, as it would directly affect them, especially in terms of traceability and export documentation, Espinola said. The postponement offers some temporary relief to the market, but there are still uncertainties.

Expectations for the palm oil market

With prices rising due to factors such as the appreciation of the ringgit and regulatory uncertainty, there are still many questions about the future of the market. “Will European countries start stockpiling palm oil? Could prices fall after the EUDR is postponed?” Espinola asked.

The impact of the conflict in the Middle East should be monitored as it could affect all global markets if the situation continues.

In summary, a combination of macroeconomic and geopolitical factors has been driving palm oil prices higher. The market remains to be seen how these developments will affect supply and demand in the coming weeks.

Source: Notícias Agrícolas