Ukraine’s grain harvests are far from the largest in the world. In fact, the US state of Iowa grows more than twice the amount of corn that Ukraine produces in an average year.

Still, Ukraine has established itself as a major global supplier of grains due to its ability to export most of what it grows. The rapid expansion of production of corn, which tripled in the 2010s, contributed to the success.

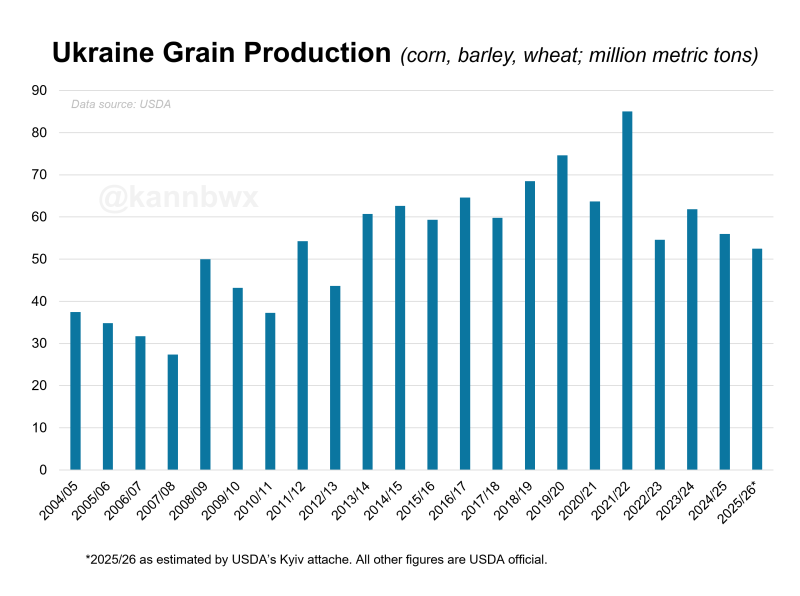

Unfortunately, Ukraine's grain production has declined considerably since the record 2021-22 harvest, harvested just months before Russia's invasion in 2022.

Some early outlooks suggest that this grim trend could continue into next year 2025-26, which, if realized, could further reduce Ukraine’s export shares and benefit rival suppliers such as the United States.

In addition, a poor wheat crop in Ukraine and relatively average prospects for neighboring Russia could put pressure on global wheat supplies through 2026.

But amid the grain crisis, oilseeds remain a bright spot for Ukrainian farmers.

Grain decline

Grain cultivation has been largely unprofitable in Ukraine since 2022 amid war-related logistical challenges and other economic factors.

Core grain production — corn, barley, wheat — in 2024-25 was among the lowest in more than a decade, falling 34% from the 2021-22 benchmark due to smaller plantings.

Last week, the U.S. Department of Agriculture’s Kyiv attaché estimated Ukraine’s wheat area harvested in 2025-26 at its lowest level in 22 years, impacted by excessively dry conditions during planting. This would reduce wheat production by 23% for the year.

Other outlooks are less grim. Analyst APK-Inform estimated earlier this month that Ukraine’s wheat harvest was down just 1% from last year, but still close to the lowest levels in more than a decade.

Bigger plantings are expected to boost Ukraine’s corn output in 2025-26 compared to last year as profitability finally improves. But a corn harvest in the range of 29 million tonnes is still well below the record of 42 million.

Online exports

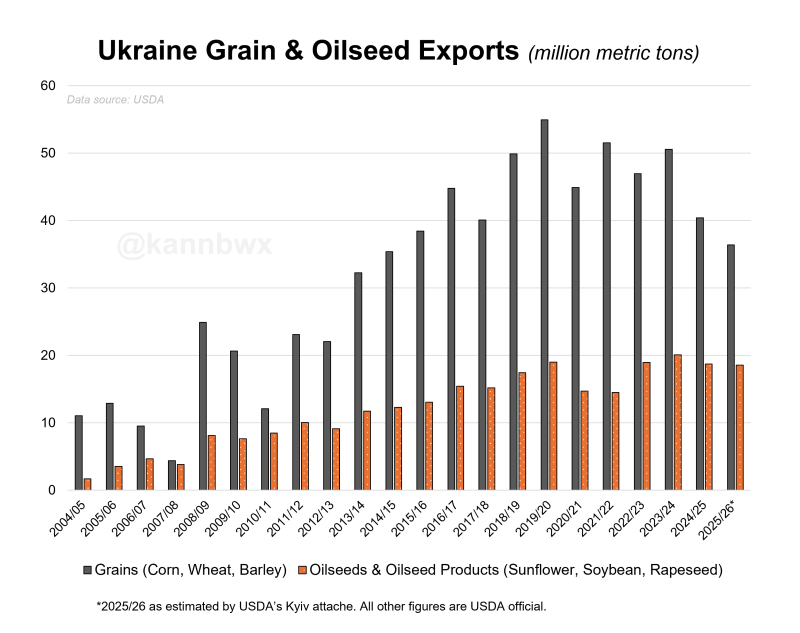

Ukraine's grain harvests need to meet or exceed expectations if the country is to regain its export market share in 2025-26.

USDA projects Ukraine in 2024-25 to account for 11.7% of global corn exports, the lowest level in 14 years and a sharp decline from 15.2% the previous year. Ukraine’s 7.7% share of wheat exports in 2024-25 would mark the second time below 8% in the past decade.

Ukraine’s grain shipments did not fall as much as its production, as the country was able to export a larger-than-usual share of its harvest. Ukraine’s livestock industry, and consequently domestic demand for feed, has struggled since the start of the war.

Ukraine recently exported over 80% of its annual corn crop and about 75% of its wheat crop. For comparison, the same figures for the United States are 16% and 45%, respectively.

Oilseeds win

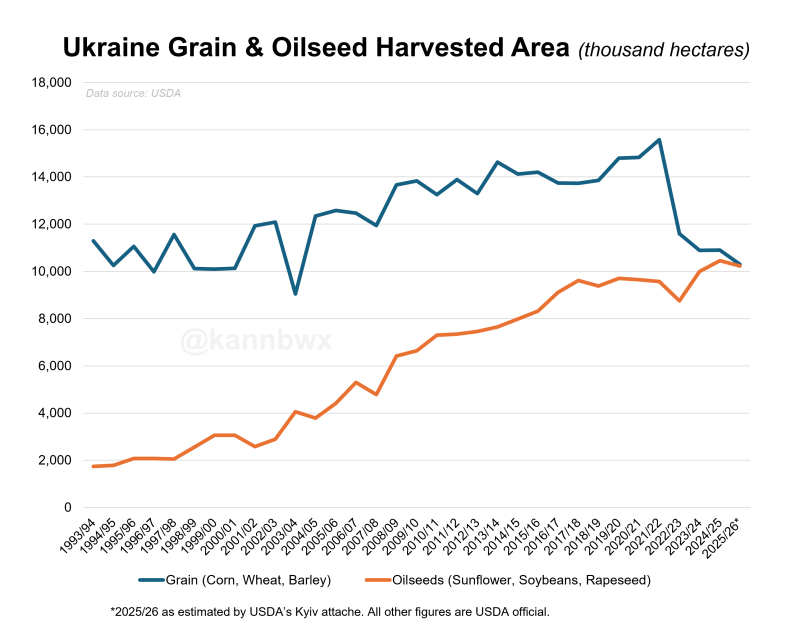

Oilseeds such as sunflower, soybean and rapeseed have offered much greater profitability potential for Ukrainian farmers compared to grains, especially since 2022.

The combined harvested area of the three oilseeds reached record highs in 2023-24 and 2024-25, increasing by more than 30% over the past decade, supported by a strong domestic processing network and high foreign demand for the products.

Canola area will likely decline in 2025-26 due to adverse fall planting conditions. The outlook is mixed for soybeans and sunflowers, but oilseed area is expected to remain robust.

Prior to 2022, the area of oilseeds in Ukraine was significantly smaller than that of grains. However, this difference may narrow by 2025-26. This would reflect farmers’ recent preference for oilseeds.

For Ukraine, exports of oilseed products such as oil and meal easily outnumber those of raw seeds. This could be advantageous for Ukraine, considering how hot the global vegetable oil market has become.

Ukraine has maintained high exports of oilseeds and products since the invasion. This shows considerable resilience of the agricultural sector. With such performance, the country may not have to give up more market share. This will be especially true if the next harvests are successful.

Source: Karen Braun and Matthew Lewis | Notícias Agrícolas