The narrative of the global market of wheat has changed recently, although it's easy to miss.

World exportable wheat supplies in 2024-25 are no longer expected to fall to multi-year lows, an outcome perhaps predictable based on recent patterns.

But the relief may be temporary. Dim prospects for upcoming wheat harvests in Russia and Ukraine, which account for about 30% of global wheat exports, mean the supply shortfall could resurface in 2025-26, and potentially for real this time.

Change of pace

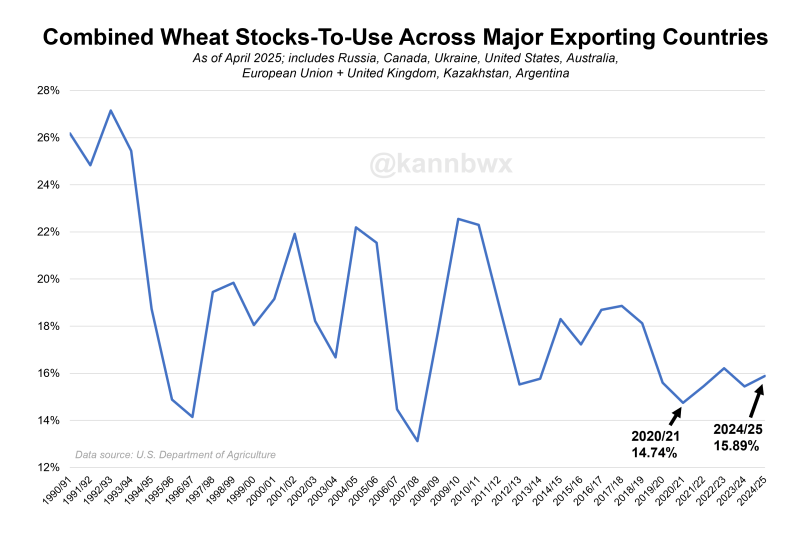

Two months ago, projections from the US Department of Agriculture showed that global wheat stocks for consumption (SU) among major exporting countries in 2024-25 would hit a 17-year low of 14.56%.

But this month’s updates put that number at 15.89%, the second highest in six years. That’s largely due to China’s lowered wheat import estimates over the past three months.

At the end of the last decade, global wheat production among major exporters was above 18%, so the 2024-25 target is still below the long-term average.

However, USDA estimates that world wheat SU will hit decade-long lows each year for at least three years, only to gradually rise as marketing years progress.

Currently, the SU of 14.74% in 2020-21 remains the lowest since 2007-08, so this is the benchmark to consider for 2025-26.

Russia and Ukraine

Last week, the USDA’s Kyiv attaché estimated Ukraine’s 2025-26 wheat harvest at 17.9 million tonnes, the lowest in 13 years and down 23% from the previous year. Soils were extremely dry during the planting period and profitability is low, reducing the area sown.

Russian agencies currently forecast a harvest of between 79.7 million and 82.5 million tonnes for 2025-26, the latter being similar to last year.

Favorable weather here could improve harvests in both countries and ease concerns, but the early numbers give cause for concern, especially as the attaché predicts that Ukraine's wheat exports in 2025-26 will be less than half the record volume.

Geopolitical and commercial impacts on the wheat market

Trade in the Black Sea has been under threat since Russia's invasion of Ukraine in 2022, mainly damaging Ukrainian exports and ultimately production.

Our chart of the day is the US Dollar versus the Euro.

Western sanctions do not directly target Russian food and fertilizer exports, but Moscow says Western countries must lift measures against Russian companies responsible for such shipments if they want their cooperation on a maritime security deal.

The data does not show any major obstacles to wheat shipments, as the Kremlin claims. The bumper harvests allowed Russian wheat exporters to record their highest volumes on record in the 2022-23 and 2023-24 harvest seasons.

Moreover, the portions of the crop exported were also record highs in those years, further obscuring Moscow's argument.

Last year's smaller Russian harvest will cut 2024-25 wheat exports to three-year lows, but the percentage of the crop exported will remain high as Russian grain is priced well below its competitors.

Promising talks on a possible ceasefire between Russia and Ukraine were underway on Tuesday. However, any conflict resolution now has little bearing on 2025-26 wheat production outlooks. Most of that crop has already been planted.

Don't forget

U.S. wheat plantings in 2025-26 are expected to fall 1.6% from a year earlier, including the smallest acreage in 55 years for the high-protein spring variety. U.S. winter wheat, as of Sunday, was in slightly worse condition than a year ago.

Argentina’s 2025-26 wheat harvest could be a record if a temporary export tax cut is extended beyond June. The move would make planting the grain more attractive to farmers.

Farmers in Canada plan to increase wheat acreage in 2025-26. Meanwhile, drought in parts of Australia could reduce the future crop by 16% compared to last year. In the European Union, soft wheat yields are expected to increase, with an estimated 8% growth compared to last year.

Together, Argentina, Australia, Canada, the European Union and the United States account for about 54% of global wheat exports. As such, these countries will also be in the spotlight on May 12, when the USDA will release its initial outlook for 2025-26.

Source: Karen Braun and Matthew Lewis | Notícias Agrícolas